Achieving venture driven growth is exceptionally hard to do – but Mach49 has the team and experience to pull it off. We are founders, operators, board members, and venture capitalists – not consultants.

Average M49ers’ work experience

21.5 years

Average M49er’s time as CxO

9.82 years

Number of startups a typical M49er has founded

6

Startups founded collectively by M49 – and running

563

Venture acquisitions / IPOs collectively by M49ers

145 exits

Total funding raised by M49ers for their startups

$6.4B

Share of Fortune 500 M49ers have worked with

292 / 500

M49ers have collectively mentored / supported / advised

1.2k+ startups

Number of VC / Accelerator Funds collectively mentored by M49ers

624 funds

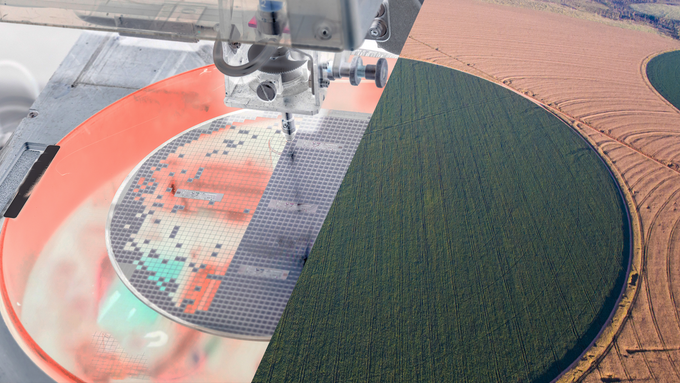

Where we’ve lived and worked

125 countries

Found a role at M49 through a referral

32% of M49